Vallejar's tax sistem

State tax and financing system

Vallejar's tax system is the means by which the state, along with all that concerns it, is funded. This system is based on the economic and social legislation presented by the constitution. It entails that 20% of all money produced within the national territory must go to the state, without distinction for any company, individual, or entity. This system is known as the "Golden Fifth".

There are no other taxes imposed on anything or anyone, making Vallejar a conducive environment for the creation of businesses and foreign investments. The continuous growth facilitated by the low tax burden makes Vallejar an attractive location, contributing to increased production and, consequently, tax revenue each year. This, in turn, aids in maintaining funding and enhancing public sectors with the economic resources received.

The way the state generates actual benefits is through foreign trade, public enterprises, foreign investments, and by providing money to other states or entities with interest rates.

It is worth mentioning that due to the fact that the Vallejar population produces nearly everything it consumes, trade with other states is beneficial. This is attributed to the quality and quantity of nationally produced goods, resulting in a surplus for export purposes.

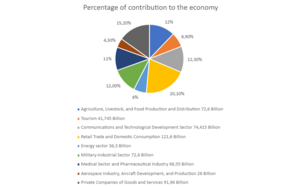

The amount of money generated by internal trade and the labor market, with an unemployment rate of 2.3%, is approximately 710 billion, representing around 63.53% of the GDP. Tax revenue is estimated to be approximately 142 billion, accounting for 12.11% of the GDP. The remainder of the GDP is based on market operations conducted by the government, contributing 463 billion, which is approximately 39.47% of the GDP. This results in a total of 605 billion available for the state to invest and finance public sectors, constituting approximately 51.58% of the GDP.

| Year | Vallejar's GDP |

| 2001 | 721 Billion |

| 2004 | 778 Billion |

| 2008 | 843 Billion |

| 2011 | 763 Billion |

| 2015 | 826 Billion |

| 2019 | 911 Billion |

| 2023 | 854 Billion |

| 2027 | 987 Billion |

| 2030 | 1,047 Trillion |

| 2032 | 1,185 Trillion |