Kinnaird Stock Exchange

Logo of the Kinnaird Stock Exchange | |

| Formerly | Arcerion Stock Exchange |

|---|---|

| Company type | Stock exchange |

| Industry | Finance |

| Founded | 1822 |

| Founder | Johnathon Roberts, AMM |

| Headquarters | , |

Number of locations | Arcerion |

Area served | Crona, limited engagements in Levantia |

| Services | Stock exchange, bond sales |

| Revenue | Market cap of £325 billion Arcer Pounds (2026) |

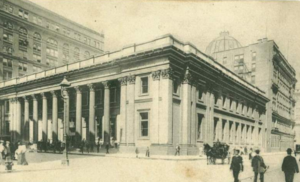

| Total assets | Kinnaird Stock and Bonds Building |

| Owner | Arcerion Finance Consortium |

Number of employees | Approx. ~2,200 |

The Kinnaird Stock Exchange (the KSX), formerly the Arcerion Stock Exchange, is the national stock exchange for Arcerion and a publicly owned company. The KSX is the parent company of multiple smaller online bond and stock brokerages.

As of the fall of 2024, the KSX had over four hundred listed securities with a combined value of £325 Billion Arcer Pounds. The main trading board is open from 9am to 3pm, which is colloquially referred to as "Kinnaird Banking Hours."

History

The KSX began as a series of disparate financial exchanges during Arcerion's colonial period of the 1790s and early 1800s. Kinnaird was emerging as a dominant financial and banking sector after several wealthy Carnish noble families and Anglic banking figures emigrated to Arcerion, settling in Kinnaird due to its small size and relatively easy ability to buy large amounts of property. The Arcerion Bondsman's Association of 1800 was the first attempt at creating a unified system of finance and stock selling for publicly traded companies. Inspired by the progress of two decades in the selling of government bonds and publicly available shares, the Royal Bank of Arcerion instructed then-President of the Arcerion Bondsman's Association Johnathan Roberts to begin the process of establishing the required infrastructure for a national stock exchange.

Johnathan Roberts used the existing Arcerion Bonds and Sales building in Kinnaird as the future headquarters, and the stock exchange received its founding charter in 1822 from the Royal Bank of Arcerion on behalf of the Carnish Crown.

In 1986, the KSX merged with the Kurst Stock Exchange (KTX) and the Dunborough Stock Exchange (DSE) to create the modern entity. A parent corporation was established in 1987, the Arcerion Finance Consortium, to manage the finances of the three structured exhcanges.

On January 1st, 1989, the KSX incorporated the first elements of computer trading, beginning the process of abolishing open-trading floor policies and practices in place for over a century. This system was continuously upgraded throughout the 1990s until the adoption of the MONEY computerized unified banking system in 2006.

The Arcerion Bonds and Sales building underwent major renovations in 2007 to become the Kinnaird Stocks and Bonds Building in 2009, reopening its doors with space for over 2,000 employees and executives.

Principal Activities

The KSX is involved in numerous financial sector activities and is Arcerion's largest single financial services provider outside of the Royal Bank of Arcerion. Its day to day operations include the regulation of securities and derivative markets, and provides the required online and in-person services for trading, after-close trading, and secure data services for the nation's central securities repository. The KSX is the largest financial firm in South Crona, and one of the largest on the continent. It is currently the only accredited and authorized security exchange remaining in Arcerion, although there have been several failed attempts at creating new national stock exchanges since 1900. The KSX provides fund for management products and low-risk portfolios comprised of several different securities, commonly traded as Exchange Traded Funds (ETFs). The KSX is also the only commodities market in Arcerion, with a significant stake in the grain, wheat, rye, gold, coal, and oil futures of the nation.