Kiravian federalism

The Kiravian Federacy is structured as an asymmetric federation in which the powers and responsibilities of governance are shared between the federal government and the governments of the various federal subjects, which include states, territories, and other regional entities, also referred to generically in Ænglish as provinces. The degree to and manner in which the federal subjects are self-governing varies according to their classification and the particular details of their constituting documents.

History

Under the Confederal Republics of Kirav, the purview of Confederal government was quite narrow, mainly limited to maintaining a common currency, enforcing customs, defensive works and raising armies in times of war, diplomatic and Urom relations, and running the Navy and postal service. The first Federal constitution significantly expanded the domestic power of the federal government, but largely maintained the assignment of the high politics of national security and foreign affairs to the federal government and the low politics of economic and social affairs to the states and territories. During the 20th century AD, the technological and economic changes of high modernity, as well as parallel developments in the Kiravian Remnant and Kiravian Union permanently disrupted the cleanly-delineated layer-cake model of Kiravian federalism. On the territory of the Kiravian Union, federalism was abolished. In the Kiravian Remnant, federalism was preserved, but the central government assumed a dramatically more powerful role in domestic affairs in order to maintain the rump federation's survival. Reunification in 1985 AD renewed public interest in subsidiarity and regional self-governance, but also a greater demand for regional parity and integrated economic development, resulting in the current arrangement of thematic and coöperative federalism.

Themes

The contemporary Kiravian Federacy is organised according to the principle of "thematic federalism" (glédistralix vuntirisēn), under which the provinces are divided among groups known as "themes" (Coscivian: glédistra). The themes were instituted under the Restoration Constitution to preserve national cohesion while addressing the differing policy needs of geographically distant regions, and to ensure fair representation of different regions in major political decisions. Themes are not a level of government in their own right and do not have any lawmaking powers. Thematic institutions, where they exist, are purely representative, deliberative, and coördinative.

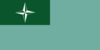

| Flag | Theme | Type | Class | Population (2030 Census) | GDP/capita |

|---|---|---|---|---|---|

| Federation of Kiravian States | Federative | General | X,000,000 | Y,000 | |

|

Commonwealth of Sarolasta | Federative | General | X,000,000 | Y,000 |

|

Sydonan Popular Republic | Unitary | Special | X,000,000 | Y,000 |

|

Melian Archipelagic Republic | Unitary | Special | X,000,000 | Y,000 |

|

South Kirav | Federative | Special | X,000,000 | Y,000 |

|

Overseas Regions | neuter | General | X,000,000 | Y,000 |

| Autonomous Regions | Federative | General | X,000,000 | Y,000 |

The themes have a constitutional role and are referenced in qualified majority voting in the federal legislative process and constitutional procedures such as the election of the Prime Executive. Themes also have a policy role: the Restoration Constitution advises that the application of federal policy should be uniform within themes as much as is prudent and vary among themes as much as prudent. Themes are most prominent in policy areas related to the movement of people and goods, as different approaches to migration controls and regulation of inter-provincial commerce have been adopted to accommodate the different development needs and cultural considerations of particular themes. In the ōvsix ("general") themes - the Federation, Sarolasta, and the Overseas Regions, such policies are set by the federal government and applied on a theme-by-theme (or province-by-province in the Overseas Regions) basis, whereas in the elurix ("special") themes - South Kirav, Sydona, and the Melian Isles - considerable authority is devolved to the provincial governments within the theme to agree upon a common policy for themselves within constitutional parameters.

Two themes - the Sydonan and the Melian - contain only one province each. In these "unitary themes", the government of the sole province represents the theme in constitutional procedures and exercises any devolved powers on its own. In most of the remaining themes, termed "federative themes", the constituent subjects create common institutions by interprovincial compact to carry out these functions. Sarolasta, for example, has a Commonwealth Council of ranking provincial legislators and cabinet officers, and a popularly-elected President who serves as a spokesman and public advocate. The Overseas Regions do not have any common institutions.

Policy distribution

Modes of Concurrence

Federal Demesne

In a sphere of spatial and functional contexts known as the federal demesne that are outside the jurisdiction of any individual province, the federal government assumes responsibilities normally belonging to the provinces, mainly in the area of administration. For example, although marriage and divorce are regulated by the provinces, the Federal government sets laws on these subjects that apply on federal military bases, federal prisons, and Kiravian-flagged ships at sea.

Provincial Administration of Federal Programmes

Provincial agencies may have a suppporting or primary role in administering programmes authorised at the federal level. For example, the process of evaluating, selecting, and monitoring projects that receive grants from the Structural Adjustment Fund (part of the federal budget), is largely carried out by provincial and sub-provincial entities known as Designated Management Authorities (DMAs), most of which are provincial and cantonal development ministries.

The Federal Highway System is federally-planned and built and maintained according to federal standards, and is funded out of the federal budget. However, construction and maintenance of the Federal Highways using these funds is the responsibility of the provinces, and the land on which they are built belongs to the Emperor in the right of the provinces rather than the right of the Federacy.

Provincial Supplementation

On subjects where federal law controls, in cases where federal law establishes a minimum restriction or requirement, provinces may enact a restriction or requirement greater than the federal minimum.

Parallelism

Foreign Relations

Perhaps the most interesting example of parallelism comes in the realm of foreign relations, where many of the more economically competitive Kiravian provinces conduct extensive paradiplomacy activities and maintain foreign trade, investment, and tourism promotion offices abroad, even though foreign relations are properly the preserve of the Federal government. In the case Protestants in Service of Kiravia v. Hanoram, the Federal Consistory ruled that states (though not other provinces) may sign concordats with the Holy See, an external sovereign entity, regarding matters within their competence.

Classes

Provinces

Non-territorial federal subjects

Statehood

Statehood is a constitutional status accorded to some (but not all) provinces.

- Full constitutional patriation - Whereas the chartered governments of other provinces are enacted (either unilaterally or bilaterally) by federal lawmaking bodies, can be revoked or suspended on federal authority, and require federal assent for amendments, state constitutions are creatures of state law alone. State constitutions must satisfy the minumum requirements laid out in Article F of the Kiravian constitution.

- Central bank equity - States are required to pay up their share of capital in the Reserve Bank of Kirav, according to a decennial capital key that accounts for each state's gross regional product and population.

- Fiscal autonomy - State governments are not subject to audit by federal agents. The wealth and debt of the States are sovereign, and the federal government cannot seize, freeze, appropriate, or otherwise interfere with state funds or financial assets. This contrasts with the situation in chartered territories/entrustancies, intendancies, dependencies, etc., where the federal government is empowered and obligated to suspend the province's charter or articles of government and assume control of its finances in order to address a fiscal emergency.

Federalism and the Emperor

From the outset of Kiravian federation, it was established that the Marble Emperor reigns both in the right of the Federacy and in the right of each province. The federal government and the provincial governments alike are instituted in the Emperor's name and govern on the Emperor's behalf. Imperial rights, powers, and prerogatives may be held at either the federal or provincial level. For example, the Emperor's power of escheat, rights to treasure trove, and ownership of amber deposits are exercised by provincial governments; whereas the Emperor's salvage rights and ownership of the electromagnetic spectrum are exercised by the federal government.

Judicial federalism

The Kiravian justice system comprises the federal judiciary and the provincial judiciaries. The provincial court systems are distinct from the federal system and from each other, with each having its own organisational apparatus, norms, and body of cultivated law and precedent.

The overwhelming majority of legal matters in Kiravia are brought before provincial courts and addressed at that level, while most of the remainder originate in federal trial courts. The scope and volume of appeals from provincial courts to federal courts is more limited in Kiravia than in other federations, and generally only occurs after the entire provincial appellate process has been exhausted. In regards to cases involving constitutional rights, federal judges apply a doctrine of subsidiarity holding that in matters where the federal and provincial constitutions are redundant, federal courts should not hear cases until provincial recourse has been exhausted.

The jurisdiction of the federal judiciary is defined by the Kiravian constitution:

Fiscal federalism

See also: Taxation in Kiravia

The taxation régime in the KF is structured to ensure that the provinces have a sufficient independent domestic revenue base to finance good governance, while also providing adequate funding for common purposes such as national defence and structural support to underdeveloped regions.

Federal government revenue comes primarily from income taxes, consumption tax allocations, and customs duties, and secondarily from a selection of excises on interprovincial commerce, most prominently energy-related taxes on fuels and electricity. Provincial government revenue comes primarily from land value tax and consumption tax allocations, and secondarily from stamp taxes and specific duties (e.g. on alcohol, tobacco, firearms, and men's magazines). Liquor taxes are particularly lucrative, and their enforcement is a high priority for provincial revenue agencies, given that liquor tax evasion is similarly profitable. In some provinces, resource rents and revenue from public lands contribute significantly to the government coffers. Whereas the scope of federal taxation power is circumscribed by the constitution, provincial taxation is not so constrained: The provinces have wide-reaching power to levy taxes of their own accord within the ambit of their respective charters, and are free to impose concurrent taxes with the federal government (e.g. a provincial income tax), and also to delegate taxation authority to lower levels of government, such as cantons, countyships, municipalities, or special purpose bodies such as water control districts and local school boards.

Both the Federacy (the Kiravian International Investment Fund) and a few resource-rich provinces (e.g. Korlēdan) operate sovereign wealth funds. The federal KIIF serves as an instrument of foreign policy and often furthers Kiravian strategic goals, whereas the provincial sovereign wealth funds mostly serve to defray certain administrative costs (for example, public school expenses) and support the government in times of fiscal emergency.

Structural and Devolved Funds

A significant share of the federal budget is received by provincial governments or involves the participation of provincial governments in managing the expenditure. This category of federal expenditure includes funded mandates (when provinces carry out a federal function or administer a federal programme at federal expense), devolved funds (funds granted to the states to manage in support of broad policy goals, such as highway funds), and more substantively concurrent programmes such as the Structural Adjustment Fund, in which both federal and provincial bodies have an active role in the management of federal funds.

The Structural Adjustment Fund is the largest and most important of the structural funds, and is intended to support economic development, maintain nationwide social stability and cohesion, and reduce regional disparities in growth and standards of living. It accounts for a majority of federal spending on domestic development aid. SAF grants are administered by the federal Development Executive together with select provincial and subprovincial agencies known as Designated Management Authorities. Designated Management Authorities receive grant applications and screen out ineligible or informal proposals. They then evaluate proposals on the merits and select which to send on to Kartika for further consideration by the Development Executive. At the federal level, the Structural Adjustment Fund Administration’s Boards of Review and Allowance make their final selections based on a "Blue Book" of federal standards, supplemented by memoranda issued by the Chief Development Executive expressing the current administration’s development strategy and priorities. Post-grant, both the DMA and the SAFA’s Office of Supervision receive reports from receiving organisations on the use of grant money and monitor the implementation of projects to ensure compliance with federal regulations and the grant agreement.

See also